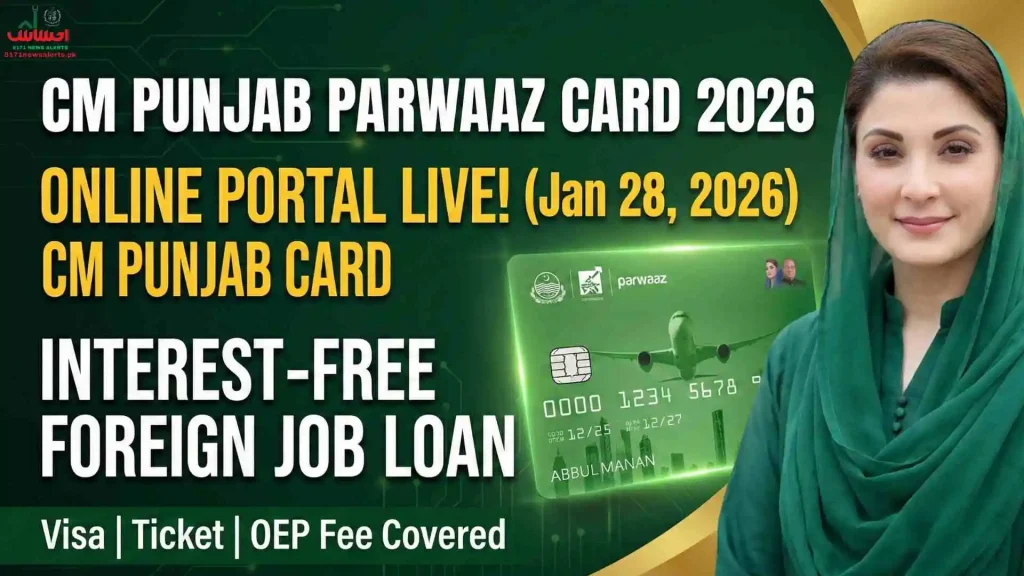

CM Punjab Parwaaz Card 2026 – Official Portal Registration | Apply for Interest-Free Loan

The wait for a fully digital application system is over! Chief Minister Punjab Maryam Nawaz has officially inaugurated the updated Parwaaz Card Online Portal on January 28, 2026.

Are you a skilled professional in Punjab with a confirmed job offer from abroad, but you lack the funds for a visa and air ticket? The Government of Punjab, through the Punjab Skills Development Fund (PSDF), has launched the Parwaaz Card. This initiative provides Interest-Free Loans to cover your pre-departure expenses.

Note: This guide covers the complete application process via Parwaaz portal for Job Seekers, Job Holders, and Partners (OEPs).

Quick Summary – Parwaaz Card Scheme 2026

| Feature | Details |

|---|---|

| Program Name | CM Punjab Parwaaz Card |

| Portal Launch | 28 January 2026 (Digital Phase) |

| Managed By | Punjab Skills Development Fund (PSDF) |

| Benefit | Interest-Free Loan (Qarz-e-Hasana) |

| Salary Limit | Job offer must be < SAR 5,000/month |

| Official Portal | parwaaz.psdf.org.pk |

What is the Parwaaz Card? (Loan Benefits)

The Parwaaz Card is a government backed financial facility designed to support low-income skilled workers. It is NOT a grant; it is an interest-free loan that you repay in easy monthly installments after you start receiving your salary abroad.

The Loan Disbursement Model (20/80 Rule)

According to the 2026 policy, the loan follows a strict split to prevent misuse:

Eligibility Criteria: Who Can Apply?

To qualify, you must meet the following conditions set by the PSDF:

How to Apply Online? (Select Your Category)

The official portal caters to three types of users. Choose the one that fits you:

Category A – Job Holder (I have an Offer Letter)

For applicants who already have a confirmed job offer.

Category B – Job Seeker (I need a Job)

For skilled workers looking for employment.

Category C – For Partners (For OEPs/Agents)

For licensed recruitment agencies.

Quick Contact Channels (Official Support)

If you face any issues during registration, use the following official channels to contact the support team.

| Channel Name | Contact Details | Purpose & Timings |

|---|---|---|

| PSDF Helpline (UAN) | (042) 111117733 (PSDF) | For portal guidance. (Mon-Fri: 9 AM – 5 PM) |

| Hunar Helpline | +92 80048627 (HUNAR) | For training & skill queries. (Mon-Sat: 8 AM – 8 PM) |

| Email Support | [email protected] | For detailed documentation. (24/7 Email Support) |

Warning – Why Applications Get Rejected?

To ensure your application is approved on the first attempt, avoid these common mistakes:

FAQs – Frequently Asked Questions

Conclusion: – Should You Apply for the Parwaaz Card?

The CM Punjab Parwaaz Card 2026 is a genuine opportunity for skilled professionals to secure their future abroad without the burden of initial heavy costs. Since the loan is interest-free and backed by the government, verified job holders should not miss this chance.

Quick Action Plan:

Recommended for Students: Are you not a job seeker but a student? The Punjab Government has also announced updates for students. Check the deadline for the CM Punjab Laptop Scheme 2026 Phase 2 here.