CM Punjab Asaan Karobar Finance Scheme – 2025

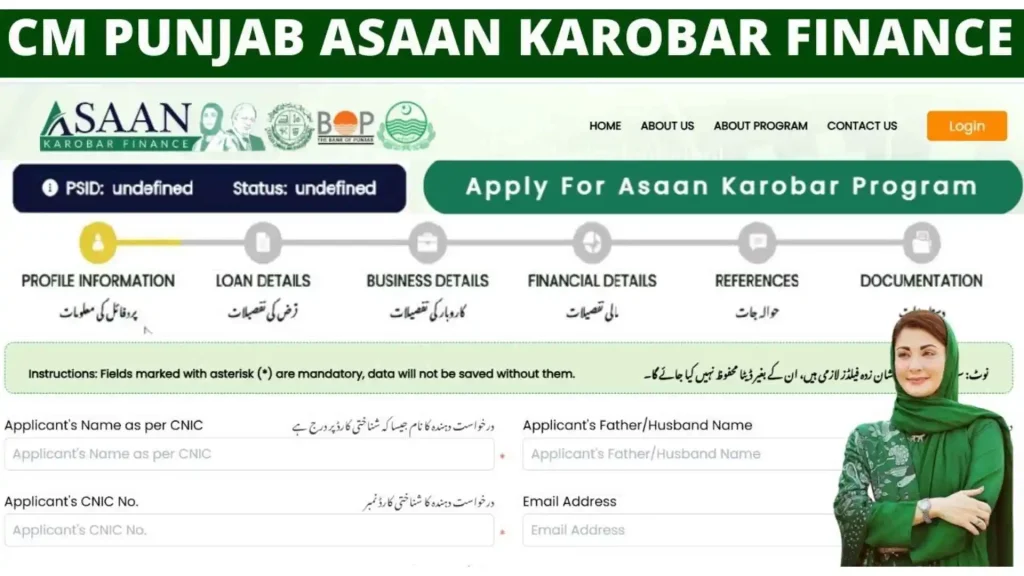

The Government of Punjab has launched the CM Punjab Asaan Karobar Finance Scheme 2025 to empower entrepreneurs and small businesses. Through this program, individuals can access interest-free loans of up to PKR 30 million. The loans come with flexible repayment terms, making them easier to manage. The goal is to promote self-employment, create new opportunities, and uplift Punjab’s economy. It also works as a powerful tool to reduce poverty across the province.

This initiative is open to men and women from all walks of life. Dedicated quotas are reserved for women, minorities, transgender persons, and differently-abled individuals to ensure inclusivity. The scheme follows Islamic banking principles, which makes financial support ethical and interest-free. By offering fair access to resources, the program aims to bring more people into business and help them grow successfully.

If you also want to apply for more program then visit Ehsaas Program CNIC check online.

What is the Asaan Karobar Finance Scheme?

The Asaan Karobar Finance Scheme is the first large-scale provincial program that provides interest-free loans to businesses across multiple industries, including agriculture, startups, and SMEs. Entrepreneurs can apply for financing of up to PKR 30 million, along with additional incentives for modern and eco-friendly ventures.

The scheme was approved in January 2025 during the 22nd Provincial Cabinet Meeting led by CM Maryam Nawaz Sharif. Alongside financial support, she announced the allocation of free land for business use and set a goal of 100,000 new startups across the province.

Additionally, the government introduced the Asaan Karobar Card (Asaan Business Card), which allows entrepreneurs to access up to PKR 1 million in interest-free credit for a three-year term. These funds are provided digitally to simplify transactions and business operations.

Objectives of CM Punjab Asaan Karobar Finance Scheme 2025

The scheme is built on a vision of economic inclusion and sustainable growth. Its key objectives are:

Loan Categories under the Scheme

The financing is structured into two tiers, each tailored for different business needs:

Tier 1 (T1):

Tier 2 (T2):

Equity Contribution Rules:

Eligibility Criteria for the Scheme

Applicants must meet the following conditions:

Application Process of the Scheme

The application process is entirely digital and designed to be simple. Steps include:

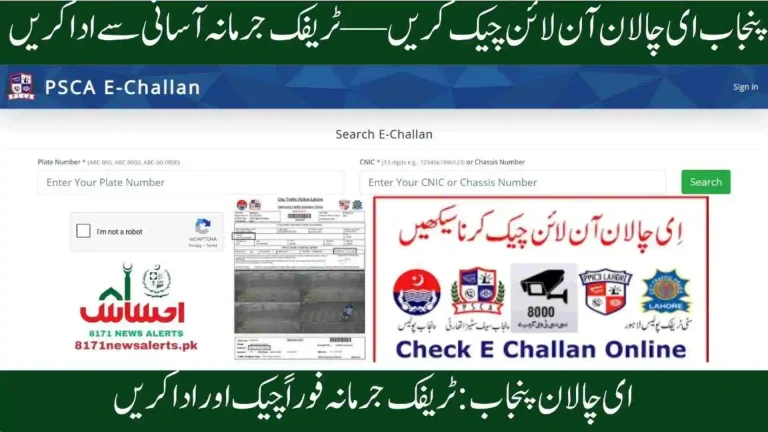

Applicants can also track their loan status online and use the official helpline (1786) for assistance or complaints.

Benefits of CM Punjab Asaan Karobar Finance Scheme 2025

The program offers more than just financing:

Future Plans – Phase II of the Scheme

The Punjab Government has already announced Phase II, expected to launch in fiscal year 2025–26. This phase will expand the program to PKR 100 billion, reaching 24,000 SMEs and distributing loans worth up to PKR 379 billion in total.

Conclusion

The CM Punjab Asaan Karobar Finance Scheme 2025 is a landmark initiative that provides entrepreneurs with interest-free financing, advisory support, and modern incentives to grow their businesses. Beyond financial aid, it focuses on inclusivity, sustainability, and innovation.

By making loans accessible, reducing equity barriers, and encouraging renewable energy and industrial modernization, this scheme empowers individuals to become job creators rather than job seekers. It represents a bold step toward economic stability and prosperity under CM Maryam Nawaz Sharif’s leadership.